What is in Your Savings Toolbox?

The key to savings management is knowing how and when to use the right tool. With so many investment options, the Florida Deferred Compensation Plan may seem difficult to navigate. Make saving easier by using the tools below.

Use the "Quarterly Performance Report" in the Plan Watch Booklet to view an updated comparison of the various investment options available to Florida Deferred Compensation Plan Participants, including Mutual Funds, Target Date Funds, and Fixed Accounts.

Interactive Income Planning Tools

Investment Allocations Affect Your Returns

Deciding the right mix for your investment allocations may help balance the risk against the reward for your long-term and short-term retirement goals. Try these resources to learn more about investing basics, account diversification, and what type of investor you are.

When Would You Rather Pay Taxes?

The Florida Deferred Compensation Plan offers payroll contributions as both 457b Pre-Tax and 457b Roth (post-tax).

| 457b Pre-Tax | 457b Roth | |

| Taxes | Pay no income taxes on contributions during your working years. Pay taxes when you withdraw during retirement. | Pay income taxes on contributions as they are made. Withdraw savings tax-free during retirement (qualifying conditions apply*). |

| Payroll Contributions | 457b Pre-Tax payroll contributions are deducted from your salary before taxes are taken, which might reduce your taxable income. | 457b Roth payroll contributions are made after taxes are taken and are subject to Federal Income Tax withholding. |

| Earnings | Grow tax-deferred earnings. | Grow tax-free earnings (qualifying conditions apply*). |

| Distributions | Distributions (contributions and earnings) are taxable as current income when withdrawn. | Distributions are tax-free (qualifying conditions apply*). |

| Required Minimum Distributions (RMDs) | If you are retired, RMDs begin at age 73. | Do not apply to 457b Roth accounts during lifetime of the owner. |

*A qualified distribution is generally a distribution that is made after a 5-taxable-year period of participation and is either made on or after the date you attain age 59½, made after your death, or attributable to your being disabled.

Pre-Tax vs. Roth Calculator

Use this calculator to help determine which option is right for your retirement: 457b Pre-Tax or 457b Roth? The calculator shows Roth 401k vs. Traditional 401k, but you can still use this calculator to get an idea of how 457b Pre-Tax and/or 457b Roth savings affect your retirement.

Prefer to Have the Help of an Experienced Professional?

Corebridge Financial and Nationwide Retirement Solutions offer additional investment guidance* for Participants enrolled in the Florida Deferred Compensation Plan.

*You must hold an account with the Investment Provider from which you wish to gain additional investment guidance.

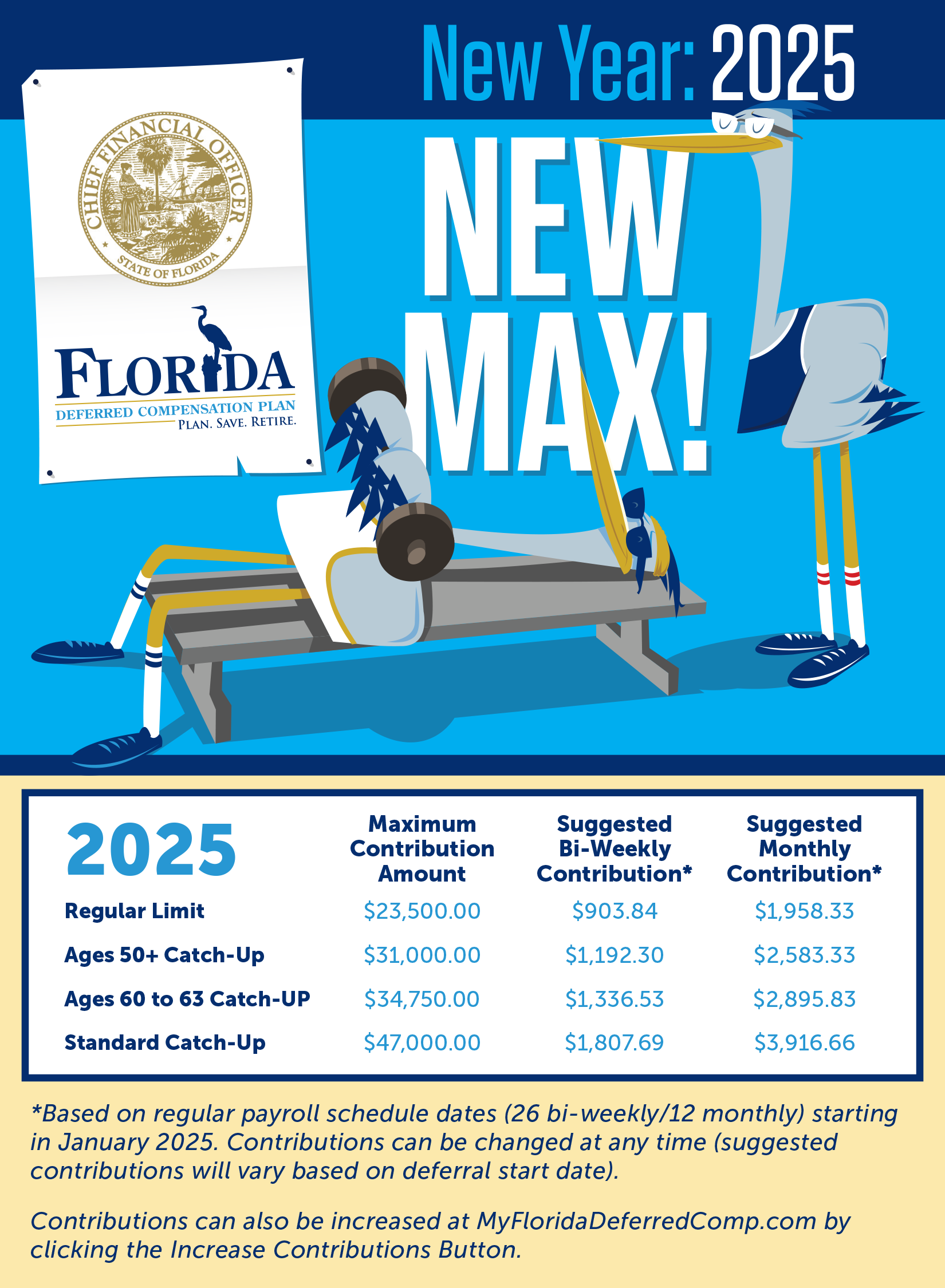

Maximize Retirement Contributions

Minimum contributions, per pay period, for the Florida Deferred Compensation Plan are $10 (bi-weekly) or $20 (monthly). Consider maximizing contributions to the Plan, and Increase Contributions, today.

This website is intended to provide information about the State of Florida's Government Employees Deferred Compensation Plan. It is not intended as investment, legal, or accounting advice. If investment advice or other expert assistance is required, the services of a competent professional should be sought. For changes to your account, go to your Investment Provider's website and log in using the ID and password you created for that Investment Provider.