Fraud and Scams

Anyone can fall victim to fraud and identity theft, but seniors are often inundated with investment offers, promises of instant wealth and requests for charitable contributions. Seniors are less likely to report fraud for many reasons: they don’t know how to report the scam, are ashamed of being scammed, or don’t know that they have been scammed. Also, seniors may not report the crime because they’re concerned that relatives may think they no longer have the capacity to manage their own finances. Unfortunately, lack of reporting contributes to keeping seniors at risk for fraud and identity theft. The alerts below will provide you with additional information on how to protect yourself from scams:

Below is the contact information for each of the three credit bureaus to place a fraud alert on your credit report.

Equifax

www.equifax.com/personal/credit-report-services/

P.O. Box 105069, Atlanta, GA 30348-5069

1-800-685-1111

P.O. Box 9554, Allen, TX 75013

1-888-397-3742

TransUnion

www.transunion.com/credit-help

P.O. Box 2000, Chester, PA 19016

1-800-680-7289

Below is the contact information to place a security freeze on your credit report:

Equifax

www.equifax.com/personal/credit-report-services/

P.O. Box 105788, Atlanta, GA 30348-5788

1-800-685-1111

Experian

P.O. Box 9554, Allen, TX 75013

1-888-397-3742

TransUnion

www.transunion.com/credit-help

P.O. Box 160, Woodlyn, PA 19094

1-888-909-8872

Consumer Scams

Scammers are always finding new ways to take advantage of consumers by stealing their financial information but seniors are especially at risk for financial exploitation. It is estimated that seniors lose $2.9 billion each year to financial frauds and

scams. Studies suggest that financial fraud against seniors goes widely unreported, often out of embarrassment or fear that they will lose independence if their loved ones find out they’ve been deceived. No one wants to feel incapable of handling

their personal finances. Scammers dupe seniors into believing scams such as: their grandchild has been arrested and money must be wired immediately so that they can be released from jail or following a disaster or devastating event, scammers will

prey on the trusting nature of seniors to seek a false contribution.

The best way to keep yourself safe from scams and fraud is information. Be aware of the ways scammers are targeting consumers so that you can spot a scam before becoming

a victim. Below are some of the top consumer scams that impact seniors to help you stay alert.

Scammers are aware that many seniors are on a fixed income and the prospect of additional funds to supplement their income make them a prime target for the advance fee loan scam. The Advance Fee Loan scam occurs when you provide money in exchange for a loan, contract, gift or investment opportunity, but receive little or nothing in return.

Pitch: Scammers guarantee that you will be approved for a loan, contract or other opportunity regardless of your credit history, but you must pay a fee upfront.

Result: The scammer will require you to sign a contract in which you agree to pay the fee. You will then find out that you are ineligible for the offer but have already paid the non-refundable fee.

How to avoid this scam: If it sounds too be good to be true, it probably is. This scam is a key example of this phrase. Before signing any agreement, thoroughly review it and make sure you completely understand it. Check with your local bank or credit union to determine your financial options.

Charitable donation scams are most popular after a disaster or devastating event has occurred.

Pitch: The scammer claims to be affiliated with charitable organizations such as: the American Red Cross, Police Benevolent Association and the Firefighters Association following a disaster. The scammer informs you that donations are being collected to assist individuals who were affected by the recent disaster in the area. The scammer claims that a goal has been set and they really need your help to reach that goal; the contribution must be made today. Contributions can be made via check, credit card or prepaid debit card.

Result: Never give out your personal or financial information over the phone unless you initiated the call. Do not be pressured into contributing. A reputable charity will be happy to take your contribution anytime.

How to avoid this scam: Only donate to local and familiar charities and research those you are not familiar with. Verify if a charity is registered by visiting the Florida Department of Agriculture and Consumer Services’ Check-A-Charity page.

Whether you are selling a couch on Craigslist or responding to a job ad, this scam usually works this way: the person you are doing business with “accidentally” sends you a check or money order for more than the amount they owe you. They ask you to deposit it into your bank account and then send them the difference via a wire service such as Western Union or MoneyGram. A deposited check or a money order takes a couple of days to clear, whereas wired money is gone instantly. When the original check bounces or the money order is returned as fraudulent, you are out whatever money you wired…and you’re still stuck with the old couch.

Pitch: The scammer will claim that they wrote the check or purchased the money order for too much and ask that you wire or transfer the difference.

Result: The scammer’s check bounces or the money order is fake and the money you sent them is gone forever.

How to avoid this scam: If possible, only take cash for payment. If you must take cash or a money order, verify with a financial institution that it is legitimate and that sufficient funds are available before depositing it into your bank account and closing the transaction. Don’t trust anyone you don’t know, especially if they are asking for money.

The new chip in credit and debit cards is designed to reduce fraud, but scammers see it as an opportunity to commit fraud.

Financial institutions and credit card companies are mailing out new credit and debit cards that have an embedded microchip, which provides another level of security, but not everyone has received the new card.

This delay allows scammers to try to capitalize on consumers who haven’t received a new chip credit card.

Pitch: You receive an email or phone call from a financial institution or credit card company stating that your personal account information needs to be updated so that your new credit card with a microchip can be issued. The scammer states that this can only be done by confirming some personal information or clicking on a link.

Result: The scammer has access to your personal and financial information and can open fraudulent accounts in your name or steal your identity.

How to avoid this scam: You can protect yourself from the chip card scam by not clicking on a link in an email, or providing personal or financial information by phone to someone claiming to be from your financial institution or credit card company. If you’re concerned that the email or call may not be legitimate, contact your financial institution or credit card company at the phone number listed on the back of your credit card or statement to verify the call. Remember, your credit card company or financial institution does not need you to verify information prior to sending a new card.

The Federal Trade Commission warns consumers to be alert for scammers posing as debt collectors. Sometimes it may be hard to tell the difference between a legitimate debt collector and a fake one. Sometimes fake debt collectors may even have some of your personal information, such as a bank account number.

Pitch: Phony debt collectors may pose as attorneys or law enforcement officers demanding immediate payment on delinquent loans or on loans you have received but for amounts you do not owe. The scammer may threaten you with garnishments, lawsuits or jail if you do not pay. These scammers will often us Caller ID spoofing. This technology makes it easy for scammers to disguise a phone number and the location they’re calling from.

Result: Consumers are threatened with lawsuits or arrests if payments are not made immediately and may end up giving money or personal information out of fear.

How to avoid this scam: Ask the scammer for their name, company, street address and telephone number. Tell the scammer that you refuse to discuss any debt until you get a written "validation notice." The notice must include the amount of the debt, the name of the creditor you owe and your rights under the federal Fair Debt Collection Practices Act. If a scammer refuses to give you all or any of this information, do not be afraid to hang up and do not pay! Paying a fake debt collector will not always make them terminate contact. They may make up another debt to try to obtain more of your money.

This scam tugs at the heartstrings of seniors who have grandchildren.

Pitch: You receive a call from someone claiming to be your grandchild and states they have been arrested in another country and need money wired immediately. The scammer asks that you don’t tell their mom or dad because this will upset them.

Result: You wire the money, only to find out that your grandchild is safe.

How to avoid this scam: Tell your family not to post travel plans online. Scammers can use online information to contact family members. Don’t trust caller ID. Scammers can disguise the number that appears on the caller ID with a practice called “spoofing.” Technology is available to scammers that make it look like they’re calling from a different place or phone number. If you get a call from your “grandchild” asking for bail money, ask for the name of the bond company and call them directly to verify it is true.

When in doubt, ask scammers questions that only your real family member would know the answer to or create a code word that only family members know to use in the case of an emergency.

Look out for home improvement contractors who leave your home worse than they found it. They usually knock on your door with a story or a deal – the roofer who can spot some missing shingles on your roof, the paver with some leftover asphalt who can give you a great deal on driveway resealing. Itinerant contractors move around, keeping a step ahead of the law…and angry consumers.

Pitch: There’s a knock on your front door and you answer it. A contractor says he has just finished a job in your neighborhood and has load of asphalt material left over. Rather than take a loss on the supplies, he offers to repave your driveway at a reduce cost. Or, a handyman shows up after a storm with a list of suggested repairs for your property.

The scammer may also offer to do work in exchange for an assignment of benefits on your insurance policy, which means once the claim is completed through your insurance company the check will be provided directly to the contractor rather than you. The claim check may exceed the actual cost of the repairs necessary for the work on your home and the work may be completed with inferior materials. Never enter into this type of agreement unless you are absolutely sure the contractor is legitimate, licensed and has the proper insurance.

Result: The work may be poor quality and you may have to redo the entire job at your own expense. The scammer may file a false or inflated claim with your insurance company, which could cause an increase in insurance premiums. The scammer may take your money and not complete the job.

How to avoid this scam: Verify Before You Buy! Verify with the DFS’ Division of Workers’ Compensation if they have workers’ compensation coverage. If they don’t, you could be liable for any injuries that happen on your property. Also, check out the company with the Better Business Bureau. Collect copies of their license and contractor number to have for your records.

Tax-related scams were the most popular in 2016. The IRS scam is a type of tax scam in which an individual claims to be from the IRS demanding payment for back taxes.

Pitch: Someone calls claiming to be from the IRS. Your caller ID identifies that the call is from the IRS. The scammer may use a false name and IRS identification badge number. To add creditability, they may ask you to verify some personal information such as: your full name, date of birth, home address, and the last four digits of your Social Security Number, all of which can be found on the internet. You are told you have an outstanding debt to the IRS and if a payment is not received immediately you could be arrested or a lien placed on your property. Typically, the scammer will instruct you to purchase a Green Dot prepaid debit card or wire the payment via Western Union or MoneyGram to settle the debt. The IRS does not use the phone, email, text message or any social media to discuss your personal tax issues involving bills or refunds.

Result: The scammers are only trying to get a quick payout. Unfortunately, it is almost impossible to recover any money you have wired or sent via a prepaid debit card.

How to avoid this scam: Do not automatically trust that a call is coming from the IRS based on the caller ID. Technology makes it easy for scammers to disguise the phone number with a practice called “spoofing.” Remember that the IRS will never call you without first sending you a hard-copy bill and it will never demand payment without offering you the chance to appeal and correct any error on your tax documents. Many seniors are not required to file tax returns because they earned little or no income. Consult with a tax professional to determine if you are required to file.

For more information, visit the IRS’ Tax Scams and Consumer Alerts page.

Jury duty is an important civic responsibility and should be taken seriously. Unfortunately, scammers will try to use it to their advantage to commit this scam.

Pitch: You receive a phone call stating that a warrant has been issued for your arrest because you missed jury duty. The scammer claims to be a law enforcement officer or court appointed official and says you owe a fine that must be paid immediately to avoid arrest. The call appears authentic thanks to caller ID spoofing. This technology makes it easy for scammers to disguise a phone number. The scammer may ask that you provide your birth date and Social Security Number to verify your identity.

To avoid arrest, the scammer states that you can pay the fine by wire transfer via Western Union or MoneyGram, a Green Dot prepaid debit card, or by providing your bank account information.

Result: Do not respond to requests for personal or financial information, or for immediate payment. Giving this type of information can open the door to identify theft and you risk paying an unnecessary fine.

How to avoid this scam: When in doubt, hang up. If you feel you have missed a jury duty summons, call your area County Clerk’s Office to verify. The court will never request your personal information or immediate payment over the phone.

Scammers try to convince seniors of new-found wealth through the lottery scam.

Pitch: The scammer will approach you in public claiming to have won the lottery but doesn’t have a bank account to deposit the funds. They will gladly share their new found wealth with you if you will provide payment upfront in ’good faith.’ Be on guard. Never deposit a check into your bank account or give money to someone claiming to have won the lottery unless you ensure the funds are available.

Also, scammers may contact you by phone or email claiming that you have won a prize or the lottery but you have to pay a fee before you can collect your winnings. They will instruct you to purchase a Green Dot Card or wire the money via Western Union or MoneyGram to pay the fees. Once you provide the ID number on the back of the Green Dot card or the verification number for Western Union or MoneyGram, the money is oftentimes gone and cannot be recovered.

Result: The check provided by the scammer is fraudulent. Typically, it takes weeks for a financial institution to discover a fraudulent check and you are responsible for paying back the full amount of the check and associated fees. If you wire money to the scammer to claim your prize, you may never hear from them again, or they keep calling you and saying that the fees have increased and you need to wire more money.

How to avoid this scam: If you won a legitimate lottery, all fees and taxes will be deducted prior to receiving the prize. Once you wire money to a scammer in a lottery and sweepstakes scam they won’t go away. The best thing to do is not to respond to phone calls or emails claiming you have won a lottery. If you hear you have won a “free gift,” vacation or prize, say “No thank you,” and hang up the phone. Be alert for individuals who approach you in public wanting to share their new fortune with you. If it sounds too good to be true…it is.

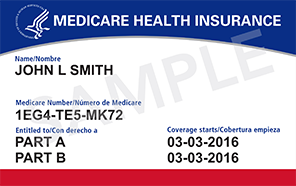

The rollout of new Medicare cards that do not include Social Security Numbers ended in 2019, yet scammers continue to call with false claims that you need to take some kind of action that will benefit only them, not you. There are no new updates to Medicare cards.

The card from Medicare is a paper card that has a blue banner on the top, a white middle, and a red banner on the bottom. However, you can print your own in black and white.

Report potential Medicare card scams if:

- Someone calls you claiming:

- You are getting a new, plastic Medicare card.

- Medicare is switching to a card with chip in it.

- It’s a new year so you need a new card.

- You need a black and white card.

- They need your Medicare number to see if you have received your new one yet.

- They need you to verify your Medicare number so they can confirm you have the correct Medicare card.

Report Suspected Fraud

To report suspected fraud, click here.

Many consumers prefer the convenience of online shopping over conventional shopping. There is no need to look for a parking space, no waiting for assistance from a salesperson or having to wait in long lines at the checkout. You are able to shop 24/7, even wearing your pajamas. The latest technology allows scammers to set up bogus retail websites that look like legitimate online retail stores. Scammers may use a logo, design and layout similar to the true website. They may even create a “.com” domain similar to the store’s name to perpetrate the scam.

Pitch: Scammers pretend to sell items or services at a discounted price to attract consumers. These unsuspecting consumers looking for bargains oftentimes fall victim to this scam.

Result: You may pay for items that are poorly made or never receive them. Payment is made by wire transfer via Western Union or MoneyGram, a Green Dot prepaid debit card, or by providing your bank account information. You could become a victim of identity theft after providing personal information. Additionally, clicking on specific links may unleash malware onto your computer or phone.

How to avoid this scam: It’s important to do your research on a company or seller before buying from them. Make sure the business has a physical address and telephone number you can contact if there's a problem. Ensure the website is secure before providing your personal financial information; if not, this may lead to identity theft. Look for the lock symbol or “https” at the beginning of the website address.

Peer-to-peer (P2P) payment services like Apple Pay, Zelle, Venmo, Facebook Payments and Cash App, offer a fast and convenient way to send money to your family and friends. Unfortunately, they are also becoming a popular payment method for scammers.

Online Advertising Pitch: This scam can appear in a variety of ways, including as a part of another type of scam. Scammers will request payment for goods or services advertised to be made through a P2P platform like Apple Pay or Venmo. Most often, this scam is seen online as part of an online retailer or classified advertisement sale scam. Scammers may also request funds through a P2P payment service as part of a romance scam, fake check scam, puppy scam or any other ploy to trick you out of your hard-earned dollars.

Target: All consumers, especially online consumers.

Result: The consumer will pay for the goods or services with a P2P payment service but never receive the product or service advertised. Many consumers mistakenly believe that P2P payment services have protections similar to a debit or credit card since many P2P payment services are affiliated with banks. This is not true. Once you send money via a P2P payment service, it is nearly impossible to get the money back.

How to avoid the scam:

- Do not use P2P payment services (Apple Pay, Zelle, Venmo, CashApp) to purchase products. If an online retailer only offers payment with a P2P payment service, it is probably a scam.

- Only send money through P2P payment services to people you know. P2P payments are intended to be used between friends and family, or with people you know well and trust, like your hairstylist or a babysitter.

- Double- and triple- check the address, username, or phone number of the person you are transferring money to. If you make a mistake and send the money to the wrong person, it can be very difficult or even impossible to get the money back. If you are worried you may have the wrong person or want to ensure the process works, try sending a very small amount first to confirm that your intended recipient received it.

- Use all security features offered. Almost every popular P2P payment service offers the ability to create a personal identification number (PIN). Once the PIN is created, a user will be required to enter it when they open the app, or before they are able to transfer money. This extra layer of security can help protect your money if your mobile device falls into the wrong hands.

For many consumers it’s a daily routine to check emails. But, what happens when you receive an email stating you have won a contest or your financial institution advises that your account may have been compromised. The email asks for your personal information to confirm receipt of the prize or to verify your account information. The email may look authentic but can redirect you to a site that downloads malware on your computer to search for sensitive data.

Pitch: You get an email or phone call informing you that you have won a contest or your financial account may have been compromised. You are directed to click on a link to and follow the directions on the page to claim your prize or verify your personal information.

Result: The scammer has access to your personal and financial information and can steal your identity.

How to avoid this scam: You can protect yourself from the phishing scam by not clicking on a link in an email that claims you have won a contest or from your financial institution asking for your personal information. If you believe the email may be legitimate, contact your financial institution via the telephone number listed on your account statement or contact the organization offering the prize at a number found online or in a directory.

In today’s world of online dating it’s much easier to search for a match, but it also makes it easier for scammers to search for their next targets.

Pitch: The scammer pretends to develop romantic intentions through online dating websites and social media to gain your affection and trust. Over time, the scammer will begin asking for money, perhaps for an airline ticket to travel to the United States to visit you, medical bills or expensive internet/phone bills to continue the relationship. The scammer will ask that you wire money via Western Union or MoneyGram or a prepaid debit card such as a Green Dot card.

Result: You send the individual money for the specific expenses and receive nothing in return, or the scammer continues to request money.

How to avoid this scam: Be vigilant while on the internet. Be cautious and leery of those you meet while on the internet and those you have never met in person. It is also advised that you do not send money to an individual that you do not know.

Don’t trust the caller ID it may be misleading. Scammers use spoofing technology to control the information that appears on your caller ID. Scammers can make you believe the Social Security Administration is calling you. If you receive a call from Social Security, you may not want to answer it. Instead, call Social Security directly at 1-800-772-1213 to determine if the call was legitimate.

Stay Informed. Rest assured, Social Security will never suspend your SSN. Also, the Social Security Administration will never call demanding payments in the form of wire transfer, gift cards or cryptocurrency.

Be cautious when giving out your personal information. Being asked to confirm your SSN or bank account information over the phone or by email is likely a scam.

- Be wary with callers claiming to know some of your personal information. Unfortunately, scammers may have obtained some of your personal information through recent data breaches. Scammers may use this to their advantage in attempting to convince you they are legitimate entities. Just because a caller knows your SSN, doesn’t mean you should share more personal information with them.

Each year consumers look forward to filing a tax return in hopes of receiving a refund that can be used to pay debt, or add to their savings or emergency fund. Identity thieves have the same goal but do so at the expense of consumers.

Pitch: The tax identity theft scam is a version of the tax scam in which a scammer uses the victim’s personal information to file a fraudulent tax return and illegally collects the tax refund. Filing a false tax return only requires the victim’s name, Social Security Number, date of birth and a falsified W-2 form.

Result: The victim attempts to file their own, legitimate tax return and receives a letter from the IRS indicating that someone has already filed in their name.

How to avoid this scam:

Enroll in the IRS Identity Protection PIN Pilot Program. If you filed your federal tax return last year with an address in Florida, Georgia, District of Columbia, Michigan, California, Maryland, Nevada, Delaware, Illinois or Rhode Island, you qualify for an IRS IP PIN, a 6-digit number that is assigned annually and adds a layer of protection for taxpayers who live in areas where tax-related identity theft is more prevalent. This IP PIN helps prevent the misuse of Social Security numbers on fraudulent federal income tax returns. If you choose to receive an IP PIN, you must use it for all future filings. Get your IRS IP PIN at https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin.

File your tax return early, even if you don't have an income, believe your income is below the minimum required to file, are self-employed or receive government benefits as Social Security. This decreases the amount of time an identity thief has to file a return in your name.

Be informed. The Protecting Americans from Tax Hikes (PATH) Act requires the IRS to hold refund checks until February 15 for consumers who claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC). Beware of tax preparation companies that claim to be able to get you your refund sooner than February 15; the company may actually be giving you a high-interest loan that will eat into your refund.

Check on the status of your refund on the IRS's website.

Take advantage of free tax preparation from legitimate organizations. Be sure to use a Volunteer Income Tax Assistance (VITA) program in your community. You can verify the company on the IRS's website.

Use the IRS’s Free File program.

If you become a victim:

File a 14039 form with the IRS.

File an identity theft report with your local police department.

Consider placing a freeze on your credit report, which prevents any credit accounts from being opened in your name.

For more information, visit www.IRS.gov and www.Consumer.FTC.gov.

Many taxpayers will utilize the services of a professional tax preparer to file their returns. Unfortunately, not all tax preparers will have their clients’ best interest in mind. In 2015, the Department of Justice, Tax Division permanently closed the doors on more than 35 tax return preparers due to fraud. Fortunately, the majority of tax return preparers are honest. But, this does not mean you should trust your tax and personal information with everyone. The tips below will help you recognize a fraudulent tax preparer to avoid becoming a victim of fraud.

Ensure your tax preparer has a current Preparer Tax Identification Number (PTIN). The IRS requires all paid preparers to have a PTIN. Check the IRS’s tax preparer directory to verify your tax preparer has a PTIN and other credentials.

Never sign a blank tax return. A signed blank return allows a scammer to later fill in credits you did not earn.

Make sure you review and ask questions about each section of your return before signing it and ensure that your preparer provides you with a completed and signed copy of your tax return.

Ask the tax preparer if they offer IRS e-file services. IRS e-file provides for a safe and secure way to file your tax return. Taxpayers receive an acknowledgement within 48 hours that the IRS has accepted or rejected their return. If the return is rejected, the IRS provides a specific explanation of the errors that caused the rejection. This allows taxpayers to make corrections and resubmit their return.

Be cautious of a preparer who only requests your last pay stub to file a return. A legitimate preparer will always request your W-2 to file a return.

Avoid fly-by-night businesses. You want to ensure the preparer will be available to answer additional questions or correct any mistakes they may have made on your return.

Discuss and agree on the fee to file before you begin. Avoid preparers whose fee is based on a percentage of your refund. This tactic allows a fraudulent preparer to increase their commission by claiming credits you are not entitled to. By the time the IRS identifies the mistake, your preparer has been paid and you could owe back taxes.

If you have a tax penalty, do not pay it directly to your preparer. Payments should be made to the U.S. Treasury. The tax preparer should provide you with a voucher that you can mail along with your check or money order to the IRS. Electronic payment options are also available, such as a direct withdrawal from your checking or savings account or payment with a debit or credit card.

Ask your trusted family and friends who prepares their taxes and whether they would recommend the preparer.

For individuals who make less than $64,000 per year, the IRS’s Free File online program does not charge a fee to file a return.

Take advantage of free tax preparation from legitimate organizations. Be sure to use a Volunteer Income Tax Assistance (VITA) program in your community. You can verify the company on the IRS’s website.

For more information, visit the IRS’s Tax Scams and Consumer Alerts page.

Many seniors are very good with computers and enjoy having access to the internet to stay in touch with friends and family. Unfortunately, many scammers attempt to prey on unsuspecting seniors who are not as familiar with how computers operate and try to trick them into revealing personal financial information over the phone or through email.

Pitch: You receive a phone call or an email from individuals posing as computer support technicians, typically Microsoft or Dell, asking to remotely access your computer or download software to fix a problem. They will try to sell you software to fix your computer or install malicious software to steal your personal information. Once the scammer has access to your computer, they are able to change the settings on your computer that could leave it vulnerable to viruses.

Result: The scammer may have installed spyware, which can cause your computer to slow down or sometimes crash. You have exposed your personal information and paid for computer software that, most likely, was not needed.

How to avoid this scam: You should never give control of your computer to a third party who calls or emails you. Do not rely on caller ID to verify a call. If you would like tech support, go to the computer company’s website and look for the support webpage or phone number. Never give out personal or financial information by email or over the phone unless you initiated the contact and you are certain the person you are speaking with is affiliated with the company.

The Lake City Police Department is warning residents, specifically seniors who attend church, about a local confirmed scam. According to police, the scammers approach potential victims claiming to be traveling prophets and healers, and ask them to open a bank account to support their travels.

The scammers deposit counterfeit checks by mobile phone and ask the victim to withdraw money once the deposits are made. The victim is accountable once it’s determined that the checks are fraudulent.

The Lake City Police Department asks the public to be aware of this scam and to not open bank accounts for others. Legitimate faith-based organizations have methods in place to collect donations.

Residents should call the Lake City Police Department if they suspect the scam.

This scam is another kind of repair scam. The deductible for a windshield repair is waived in Florida and most states. Scammers use this information to con unsuspecting consumers into committing insurance fraud.

Pitch: The scammer approaches you in the parking lot of a grocery store or gas station, for instance, claiming that you have small chips or nicks in your windshield. They offer to replace the windshield to prevent from becoming cracked causing further damage. The scammer will misrepresent to your insurance company that the windshield is seriously damaged and needs repairing.

Result: The scammer is most likely not a licensed repairman and is not authorized to complete the repairs on your windshield. Many of these individuals may not be trained or are poorly trained, work out of vehicles with no physical business address and disappear quickly after completing substandard repairs. They may also charge your insurance company for inflated or baseless expenses and subpar materials.

How to avoid this scam: Contact your insurance company before allowing the repairs to be made. The company will help you confirm if the windshield needs to be repaired and find a reputable glass vendor.

Assignment of Benefits: Sometimes repair shops or their representatives may approach the claimants to assign their insurance claim benefits to them for glass repair. Such agreements are generally known as ‘Assignment of Benefits’, whereby a policyholder assigns their claim benefits to someone else. For policies issued or renewed on or after 07/01/2023 by authorized insurers, such assignments for glass repair and/or calibration or recalibration of Advanced Driver Assistance Systems (ADAS) are prohibited. These assignments are considered void and unenforceable. This prohibition applies to motor vehicle glass claims, including windshield claims.